The Impact of E-Commerce on the Real Estate Warehouse Market

Are U.S. warehouses and distribution centers ready to meet e-commerce omnichannel fulfillment demands?

U.S. Warehouse Space Today

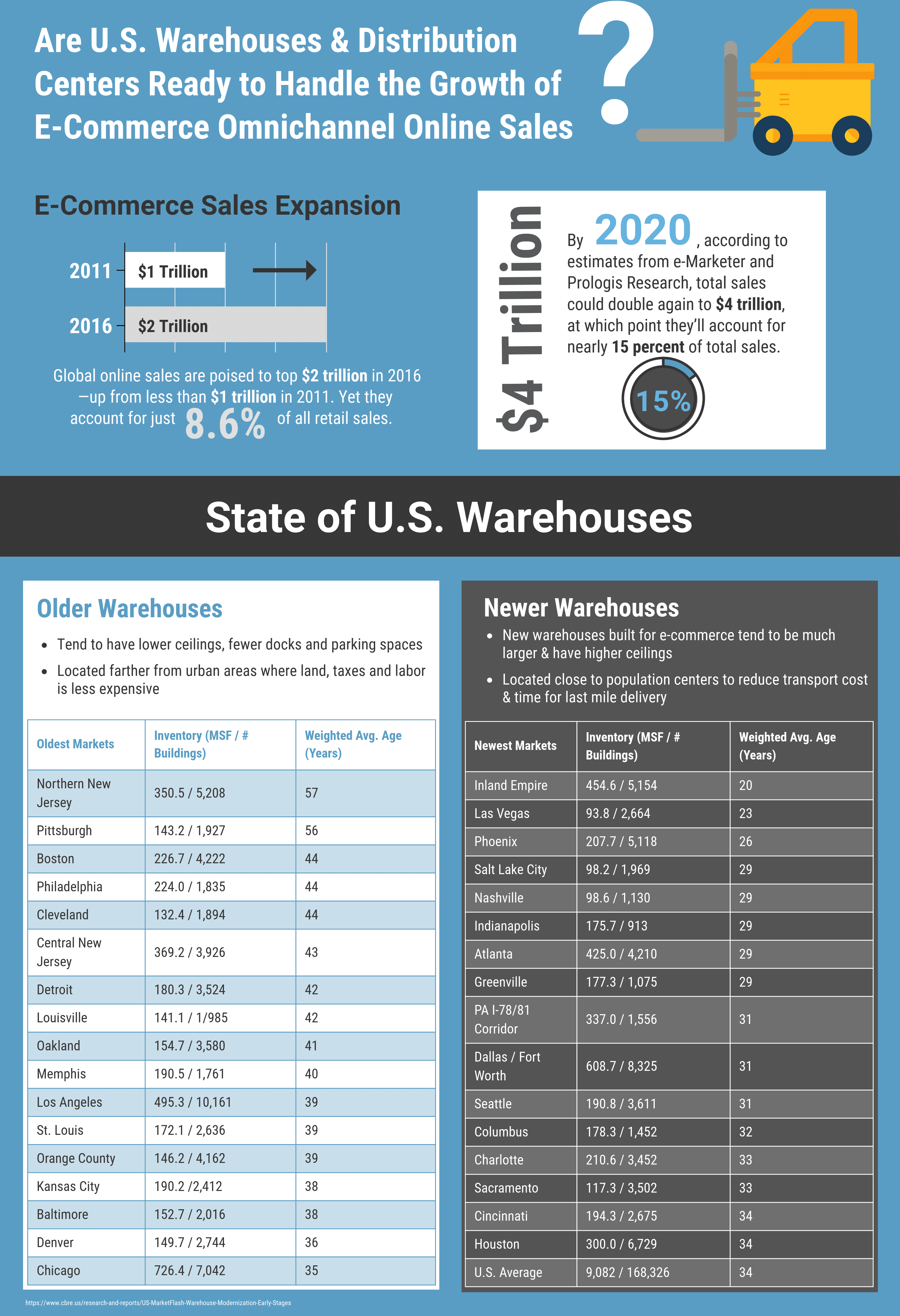

E-commerce online shopping is having a significant impact on the industrial real estate market across the United States. Although online sales are less than a tenth of overall retail sales, according to the U.S. Census Bureau, e-commerce retail revenue increased at four times the pace of total retail sales. Big box retailer Walmart reported that they anticipate e-commerce sales to increase at a pace of 50% year over year.

Recent commercial real estate industry reports indicate that U.S.-based warehouses and distribution centers are facing increasingly tight market conditions. According to CBRE, availability in the first quarter of 2018 declined for the 31st consecutive quarter. An examination of this on an annual basis shows that the availability rate has dropped 20 base points per year. Largely due to the increase in e-commerce activity, the demand for United States-based warehouse and DC facilities has continued to increase steadily.

On average, online retailers require 1.2 million square feet of warehouse or distribution center space per million dollars of online sales, three times the requirement for that of brick-and-mortar retailers. This is driving up demand for warehouse and DC space, an increase of 20% of new leasing for DCs by e-commerce companies.

The e-commerce industry is fueling demand but still is expected to continue to expand.

Demand is expanding beyond the primary cities and into secondary and tertiary markets due to the low vacancy rates, coastal barriers and increase of e-commerce activity.

Satisfying consumers with fast delivery

The Impact of E-Commerce Omnichannel Retail

Real estate industry reports by experts CBRE and Prologis indicate that warehouses are changing to meet pressing needs of e-commerce fulfillment. In years gone by, warehouses and distribution centers were situated away from population centers in areas where costs for land, taxes

Here are some other insights from the CBRE report “Old Storage Warehouse Modernization in Early Stages”:

- U.S. markets that have the newest warehouses tend to have a large amount of land that can still be developed and are near major population centers

- U.S. markets with the oldest warehouses are most likely to serve heavy industrial and shipping centers

According to Prologis, nearly 20% of the new leasing of warehouse space is due to e-commerce, an increase of 5% within the past five years. This is only the beginning as global e-commerce online sales are projected to

Land shortages in some areas

Warehouse and Distribution Center LOCATION, LOCATION, LOCATION

Whereas years ago, the location of shopping malls and brick and mortar retail stores was essential to the success of retail, now warehouses and distribution centers must be located near population centers to ensure rapid last mile delivery. This reduces time and transportation costs, vital to keeping home delivery costs low for consumers.

To do this in mature markets, omnichannel retailers are searching for “infill locations”, vacant or underutilized parcels of land within or immediately adjacent to urban areas. Retailers need diverse sizes of warehouses in different types of locations to meet e-commerce fulfillment needs. For example, 40,000-60,000 square foot warehouses located in urban areas are most frequently used as the last stop in

Bigger, More Technologically Advanced Warehouses in 2018

Because of the incredibly fast pace of operations, wide variety of goods and SKU proliferation and other factors, the size of warehouses and distribution centers has increased significantly. Warehouses today are far more technologically advanced than those of even ten years ago.

- Several Amazon warehouses have over a million square feet of space

- Nike’s Memphis 24/7 distribution center has 2.8 million square feet of space and 33 miles of conveyor belt under a single roof

Conclusion:

The continual growth of online shopping is fueling the demand for warehouse and DC space and major changes across the supply chain. As many U.S. warehouses were constructed before the year 2000, the facilities are smaller and inadequate. Location remains critical for warehouses and distribution centers in order to meet the need for same day delivery to consumers.

What Makes Datex Different?

1. Revolutionary low code/no code flexible workflow-driven warehouse management software

2. Most configurable, user-friendly WMS on the market today

3. End-to-end solution provider: software, hardware, EDI, and managed services

4. White Glove Concierge Service

5. Executive-level attention and oversight